for independent advice, call us on 01372 374444

or email us at enquiries@cleigh.com

How Much Risk Can You Take?

When investing your hard earned cash, there is one empirical truth that you must understand - nowhere that you can put your money is entirely free of risk!

Even bank deposits carry quite a lot of risk. There is always the possibility that the bank could run into difficulties and go bust, like Lehman Brothers. Governments have done their best to shore up the high street banks and in the UK provide guarantees on the first £85,000 held by a depositor in any one bank. However, perhaps the greater risk on bank deposits is the risk of capital erosion by inflation.

If your bank pays you interest at 3% per annum but inflation rises by 4% you will in effect lose 1% of the value of the money per year. Inflation is different for all of us depending on what we buy. The government gives us a rate for CPI (Consumer Prices Index) each month which is based on a “basket” of goods Mr and Mrs Average might buy, but who are Mr and Mrs Average? The truth is that if you are retired and mainly buy food, services, travel etc, your inflation rate could be much higher. If you are working and spending on mortgages, consumer durables and computer games, your rate could be a bit lower. Your rate will be individual and determined by your spending habits.

Even investing in government securities (gilts) entails risk. The value of these will change, falling when interest rates rise and vice versa. Over time, inflation will also have an effect on index linked gilts if the inflation rate declared doesn’t match your own personal inflation rate.

Does the risk I take decrease over time?

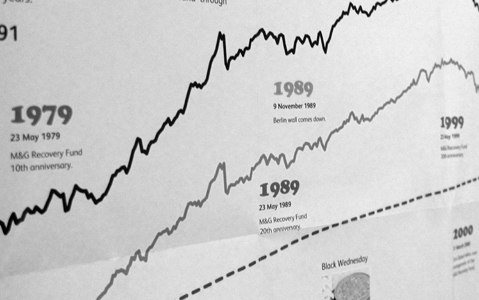

To a certain extent this assumption is true, particularly when markets are volatile. It is easier to predict the movement in an asset price over a medium term of say 3–5 years rather than over a short term of 1–2 years. However, it doesn’t necessarily follow that this is true in the long term as so much can change.

Investing with a medium term view will give you the ability to make changes to your strategy based on developments over time.

How can I best manage my risk?

In a word – Diversify.

By investing your money across a broad range of assets and stocks you can spread your risk into areas that are not related and where their values will change to varying influences. For example, over recent years the gold price has risen whereas property prices have fallen. By mixing the two in your portfolio you could have managed your overall return, offsetting losses on property with gains in gold. No single asset class will continuously outperform and one can never accurately predict the best performing asset class over any given time – so it pays to diversify.

In an ideal world and in fact in practice, investors who take more risk with their money will in time receive higher rewards. Generally those who invest in businesses (shares) will receive better returns than those who invest in safer areas such as government securities. However this is by no means always the case. In general, if one is looking for higher growth one holds a higher proportion of shares (UK and overseas) and lower proportions of property, fixed interest securities and cash which tend to be more stable.

To gauge the proportions of each asset class you should hold, according to the level of risk you want to take, actuaries have devised a short questionnaire which we can use to give us a starting framework for constructing your portfolio (see attached). This is by no means foolproof and must be used in conjunction with a view of the prevailing economic conditions at the time of the investment. It does, however, give us a starting framework upon which we can build, making slight tactical adjustments to make best use of current market information and trends (demographics, currency movements, political influences, news, etc).

Therefore it is important that your investments are monitored and adjusted in line with the changing market conditions over the years.

What is the downside risk?

When investing over any period in any asset, one needs to accept that value can be lost, either temporarily or permanently, as assets come in and out of fashion. Downside risk can also be reduced by diversification, as in most instances asset classes that are not correlated will come in and out of fashion, and rise and fall in value, at different times and in different conditions. The “blend” of asset classes is important. The higher the exposure to assets like shares, the more volatile the overall value can be. It is, therefore, important that the blend of investments is right for the level of potential loss that you could endure temporarily without adverse consequences.

There will always be some volatility in any blend, which is why we always encourage you to keep part of the funds in cash as you may need money at short notice at a time when the value of your portfolio has dropped temporarily. Once we have established the correct blend of asset classes for your personal risk tolerance, we set about selecting the best managers in these areas for you. We also look at the most tax efficient vehicles for you to hold those asset classes in, so that you keep as much of your returns as possible, in light of your personal tax position.

We then build a robust portfolio which is diverse and well looked after by the best asset managers available. This is frequently reviewed and is flexible enough to change if your personal circumstances change.

In order for us to assess your risk profile, please see attached Retirement and Investment Risk Planning Questionnaires.